In a breathtaking shift that has rewritten the global financial landscape, a new class of billionaires has emerged, their fortunes fueled by the rapid ascent of artificial intelligence. Tech moguls whose companies provide the chips, data centers, and software underpinning the AI revolution have rocketed up the world’s rich list, amassing unprecedented wealth at a dizzying pace. This is the AI gold rush, a modern-day frenzy driven by a powerful narrative of a technology that promises to transform every industry and reshape the very fabric of our lives. But as market valuations for AI-related companies soar into the stratosphere, a single, haunting question echoes through financial markets and boardrooms alike: is this a genuine, long-term economic boom, or simply another speculative bubble waiting to pop, reminiscent of the dot-com era?

The New Titans of Technology

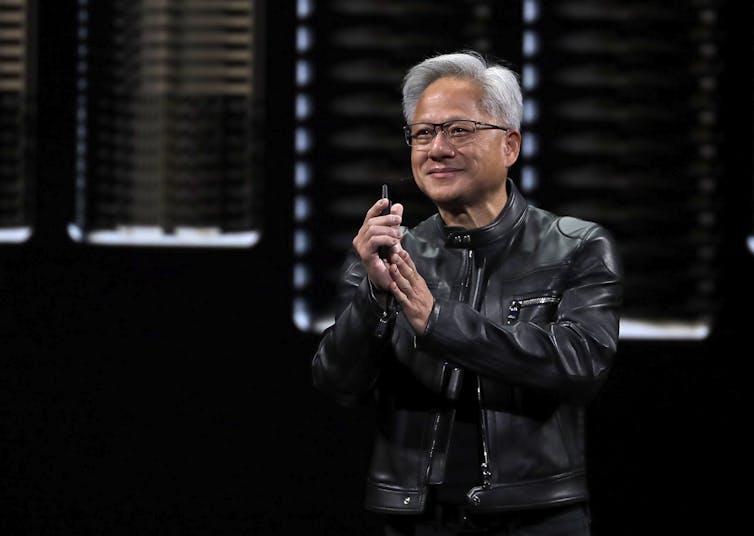

The evidence of AI’s financial impact is unmistakable and dramatic. A quick glance at the world’s wealthiest individuals reveals a seismic shift, as figures from the energy and retail sectors are displaced by a new breed of technology titans. The CEO of NVIDIA, a company at the heart of the AI revolution, has seen his net worth skyrocket as his company’s valuation has surged past trillions of dollars. He is not alone; a cohort of entrepreneurs and investors from companies specializing in cloud computing, data analytics, and foundational AI models have seen their fortunes grow at an exponential rate.

This isn’t a random occurrence. It is a direct result of investor confidence, as venture capitalists, institutional funds, and retail investors alike pour billions into any company with a clear link to artificial intelligence. They are betting on the idea that AI is not just another technological trend, but a fundamental, transformative force that will unlock unimaginable productivity gains and create entirely new industries. This unprecedented accumulation of wealth is a clear signal that AI is already a major economic driver, and its impact is just beginning to be felt.

Genuine Progress or Speculative Hype?

The debate over whether this is a boom or a bubble is at the heart of the conversation. Proponents of the boom theory point to the real and tangible progress being made in AI. They argue that this is not just “internet 2.0,” but a technology with a clear path to profitability and real-world application. They point to the use of AI in drug discovery, where it can shorten a decades-long process to a matter of years, or in logistics, where it can optimize supply chains to an unprecedented degree. The massive investments in AI infrastructure, from new data centers to specialized chip manufacturing plants, are seen as evidence of a foundational shift in the global economy.

Conversely, those who argue that this is a bubble draw powerful parallels to past market frenzies. They point to the dot-com bubble of the late 1990s, where companies with little to no revenue or business model were valued at billions of dollars based on pure speculation and the promise of a digital future. They argue that some AI companies today are in a similar position, with valuations that are detached from their current profitability and based on an assumption of a massive, future market that may or may not materialize. They warn that the intense hype, media coverage, and public fascination with AI are all classic signs of irrational exuberance that could lead to a painful market correction.

The Economic Landscape: A Tale of Two Realities

The AI boom, whether it’s a genuine one or a bubble, is creating a stark dichotomy in the global economic landscape. On one hand, a small number of companies and individuals are amassing a staggering amount of wealth, driving up valuations and creating a new class of super-rich. On the other hand, a vast majority of the global economy and its workers are not experiencing these same benefits. Wage stagnation in many sectors and a growing sense of economic inequality stand in sharp contrast to the soaring fortunes of the AI elite.

Furthermore, the promises of AI, particularly in automation, are creating a sense of anxiety in the labor market. While some argue that AI will create new, higher-paying jobs, others fear that it will displace millions of workers in a wide range of industries, from manufacturing to creative fields. This uneven distribution of economic benefits and the fear of widespread job displacement add another layer of complexity to the AI boom, highlighting the ethical and social challenges that are a direct result of this technological revolution.

Looking Ahead: The Future of AI’s Economy

Ultimately, the question of whether this is a boom or a bubble is less important than what happens next. The underlying technology of AI is real and transformative, and it is here to stay. The question is not if AI will change the world, but how its economic value will be realized and distributed. A market correction, should it occur, might not be a disaster but a necessary and healthy reset. It would serve to clear out the speculative froth, allowing the genuinely valuable companies with sound business models to emerge and build a sustainable economic future.

The future of AI’s economy will depend on a number of factors, including responsible investment, thoughtful regulation, and a commitment to ensuring that the benefits of this technology are shared more broadly. The lessons of past booms and bubbles are clear: the promise of a transformative technology is not enough. It must be paired with sound business practices, a clear path to profitability, and a profound sense of social responsibility. The AI revolution has the potential to create a more prosperous and equitable world, but only if we navigate its financial complexities with wisdom and foresight.