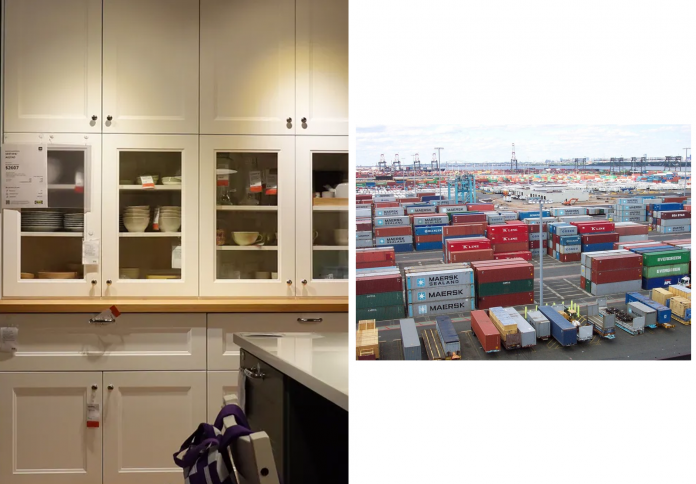

New tariffs, ranging up to 25 per cent, have officially gone into effect in the US on imports of kitchen cabinets, certain upholstered furniture, and softwood lumber. These tariffs, announced via a White House proclamation in late September, are part of the Administration’s broader strategy to increase domestic timber production and reduce what it considers an “overreliance on foreign timber” which could jeopardize US “defense capabilities, construction industry, and economic strength.” The move immediately impacts the architecture and design industries by raising the cost of essential building and furnishing materials, with key industry figures already expressing concern that the tariffs could have a “brutal” impact on the sector.

Initial Rates and Scheduled Increases

The new suite of tariffs, which took effect on October 14 following a two-week delay, targets specific wood-based product categories. The tariffs are not static, with scheduled increases set to take effect on January 1 of the following year:

- Softwood Lumber: An initial 10 per cent global tariff went into effect, which is set to rise to 30 per cent in January. Much of the softwood lumber used in US construction is typically imported from Canada.

- Kitchen Cabinets and Vanities: A 25 per cent global tariff is now in effect for these items, including parts imported for their assembly. This rate will significantly jump to 50 per cent on January 1.

- Upholstered Wood Furniture: This category, which includes items like couches, sofas, and chairs, has an initial 25 per cent global tariff, which is also set to increase to 30 per cent in January.

The Administration’s Rationale: Defence and Economic Strength

The Trump Administration justified the tariffs by citing national security and economic concerns. The official proclamation argued that an excessive reliance on imported timber and its derivative products poses a risk to the nation’s “defense capabilities” and its “construction industry, and economic strength.” Research conducted by the administration supported the claim that lumber is vital for the construction of both civilian and military infrastructure, and that the US possesses the necessary “raw materials and industrial capacity” to meet its own needs domestically.

The tariffs are intended to act as a punitive measure on foreign goods to encourage US construction and design firms to source and manufacture materials within the country. This policy follows an earlier executive order released to directly increase domestic timber production, alongside a Commerce Department “tariff investigation” into the US furniture industry announced in late August. The administration’s goal is to stimulate US manufacturing jobs and strengthen domestic supply chains, particularly in critical sectors like construction.

Industry Backlash and Economic Consequences

The implementation of the tariffs has generated significant concern across the architecture, construction, and design industries. The immediate effect is a substantial increase in material costs, which will likely be passed on to consumers, potentially cooling the housing and renovation markets.

Industry leaders have voiced skepticism about the feasibility of quickly shifting manufacturing back to the US. Farooq Kathwari, CEO of furniture company Ethan Allen, noted that “[g]etting manufacturing started in the US isn’t easy.” The tariffs’ impact is not theoretical; one reported instance involves a mass-timber construction project in Milwaukee that had to be stalled due to the imposed duties, demonstrating the real-world obstacles these policies create for the construction pipeline and for innovative materials like mass timber. The consensus in the design community is that the tariffs will have a “brutal” impact on the industry at large by disrupting established supply chains and raising costs without the immediate, necessary infrastructure to replace the imported goods domestically.